Tuesday, 21 February 2023

The Star disgraced itself last week. Here’s why it’s a Buy and these 3 ASX peers may be even better

by Berkeley Lovelace

Poke about a bit during a good long lockdown or perhaps a looming recession and there’s always the odd ASX wagering and sports stock somewhere in the portfolio that’s worth keeping up the sleeve as a handy hole card or as part of a defensive spread.

But as the Reserve Bank appears more determined than ever to reverse engineer an economic downturn, picking the right name lately is more like a Melbourne Cup office sweepstake than a bet against Australia cricket in Chennai.

As Stockhead’s Tim Boreham’s observed many a time, it was a heap easier a decade ago, when Tabcorp (ASX:TAH) and Tatts Group accounted for almost all the racing and lottery gigs that mattered as well as Victoria’s lucrative pokie trade.

“A 2008 Victorian government decision stripped the two Ts of their pokies franchise and in 2011 Tabcorp hived off its casino business as Echo Entertainment (now cringing about the place as the disgraced Star Entertainment Group),” Tim says. “Hey, even the blushing suitors, Tabcorp and Tatts merged in 2017.”

In what was eventually an amicable divorce, Tabcorp de-merged the lotteries business as The Lotteries Corporation (ASX:TLC), leaving Tabcorp with the nags, sports betting and media (primarily Sky Racing).

I mention this for both context and in passing, just because not very many people seemed to note what an absolute shredding The Star’s share price went through last week.

Let’s unpack that first, and then consider your options in this hallowed defensive sector of the ASX.

So, yes. Star Entertainment (ASX:SGR) wandered quietly off another cliff on Monday last when the casino operator released an earnings and guidance update so obviously toxic that it’s amazing they didn’t ask the Surgeon General to first wrap it up in spare tobacco packaging.

Star reported just awful revenue at its nigh carcinogenic Sydney casino brand, amid an equally awful cost and headcount blowout. Investors were warned, but perhaps not as well as smokers, of a non-cash impairment charge of somewhere between $400 million and $1.6 billion. When the company next fronts shareholders at FY earnings, someone’s going to cop it for that.

By Tuesday morning, the stock had lost more than 21% to a bell-dinging new record low. Unsatisfied by that achievement, shares ended the session another 13.5% down, to a new all-time low of $1.28 a share.

Star’s down circa 80% from its all-time high of early 2018 that saw the company above $6 a share, with a wee new market cap of $1.4 billion. Not good.

UBS analyst, Andre Fromyhr, says this year Star’s Earnings Per Share (EPS) are down by more than half.

“Star is revised down -51% in FY23 and the target price is lowered -48% to $1.95 per share, reflecting the recent FY23 trading update and increased compliance and remediation costs.”

UBS has also included a 68 cents per share (CPS) impact to valuation for estimated fines and a 60cps risk-weighted impact for a potential increase in NSW casino duties.

Making America Game Again

On the whole it would appear, the Great American Gaming Dream is still on for TLC and Aristocrat Leisure (ASX:ALL) according to both Macquarie and UBS. These two Aussie-listed machine makers slot right into any decent, hard-headed, bloodsucking pokie portfolio worth a flutter.

Macquarie Bank, always ready to spell things out for its clients, could’ve banged on at length about the evaporation of regulatory hurdles across many of the US states with bored wealthy people and/or the consequent proliferation of dens of inequity to entice such victims.

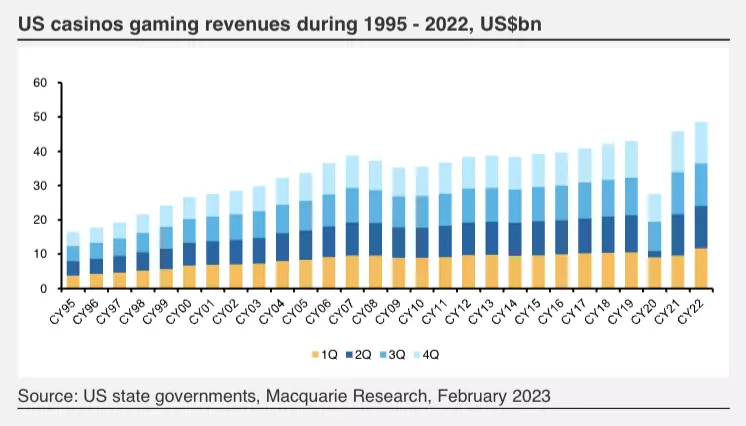

But the drawing below says all anyone needs to know: consecutive, excessive record US gambling spend in 2021 and 2022 and that’s come from the slots part of the casino. And there’s 2 x Aussie names which do that best.

“US casino revenue trends continue to support the thesis that the industry is resilient and less susceptible to economic volatility,” Macquarie notes.

“As such, we remain positive on the outlook for the slot manufacturers, in particular Aristocrat with ongoing market share momentum within outright sales and gaming ops underpinned by product performance.”

UBS are also most enthused by TLC and ALL, which they name as their preferred exposures in the sector.

A week after shifting to white-labelling Morningstar’s research, Ord Minnett downgraded Lottery Corp to Lighten from Accumulate and trimmed the target price to $4.40 from $4.95.

UBS reiterated its Buy Rating late last week for TLC with a price target of $5.70, saying the TAH spinoff has rallied strongly in recent months, but that there’s still potential upside.

“TLC should continue to be rewarded for its defensive cash flows, especially heading into a tougher macro context. And while its yield is only ~3% on FY23E, UBS forecasts 10% CAGR for the following three years,” Fromhyr says.

He has Lotto Corp’s EPS revised upwardly by +7% in FY23. That’s mostly reflecting updated lottery results over the last few summer months.

UBS see ALL as providing a growth proposition that is less linked to global macro than other discretionary exposures, and they expect strong FCF generation to provide increased flexibility for growth investment and/or further capital returns. It’s a Buy rating at UBS with a Price Target of $41.60.

According to Citi, Aristocrat’s continued to outperform, even as the digital industry bookings have pretty much flattened out.

Citi likes what’s been happening at its Social Casino portfolio, where bookings have outperformed, up 8% year-on-year compared to an industry average of 3%. At the same time a decline in bookings for the RAID platform of -6% year-on-year was less of a positive, more of a bummer. Even so, with RAID continuing to outperform the broader RPG genre, Citi is cautious not to read too much into what’s been limited data so far.

Citi retains a Buy rating on ALL and a target price of $41.20.

As we’ve mentioned, UBS says The Star’s EPS is cleft in twain (down -51% in FY23) and the target price is likewise eviscerated by -48% to a what should be an entirely doable $1.95 per share.

That’s in light of the aforementioned FY23 trading update which, were it a Hollywood script, reads like a Ben Affleck/JLo musical drama co-written by Quentin Tarintino and Dolly Parton. There’s a Third Act which runs for about 90 minutes of nothing but increased compliance and remediation costs put to country and western. UBS has also included a 68cps impact to valuation for estimated fines and a 60cps risk-weighted impact for a potential increase in NSW casino duties.

The stock has fallen even further than UBS’ valuations dreamt of. The sheer breadth and depth of those regulatory and compliance issues have literally made the case for SGR having found a bottom. So much so anyway that UBS sees potential upside as a relatively strong bet.

However, it comes with risks attached and they see a wide range of valuation scenarios, most significantly depending on the scale and form of the proposed NSW casino duty and the potential AUSTRAC fine.

TAH’s also a Buy for UBS with a trimmed down EPS (-3% in FY23) but the target price is lifted +5% to $1.05 per share. That’s reflecting stronger cost growth in the short-term but decently offset by margin improvement after the renewal of the Vic licence.

On the other foot, last week MQG downgraded TAH to Neutral from Outperform, on an unchanged $1.10 target. Macquarie has already made it clear that the bank remains cautious on Wagering & Media full stop – considering the intensifying competition, including new entrants, and the waiving of Sky Channel fees in pubs and clubs.

MQG analysts now see Tabcorp as ‘fair value’. There’s downside risks for the bank within the broader wagering business and uncertainties regarding licence renewals. On the plus side, the possible upside to earnings through a levelling of the playing field within markets outside of Queensland.

Opal Capital’s Omkar Joshi has said before that in this kind of environment it’s more important than ever to pick stocks that are resilient in a tougher economic backdrop.

“Tabcorp Holdings has at least been among the more recession proof,” Joshi said.

UBS meanwhile, also doesn’t see too much strong valuation upside for TAH. They retain a Neutral rating with an unchanged PT of $1.05, and there remains uncertainty about the company’s ability to innovate and win share in the highly competitive digital channel – though UBS adds, somewhat unhelpfully, that the stock could re-rate promptly on first evidence of success.

The post The Star disgraced itself last week. Here’s why it’s a Buy and these 3 ASX peers may be even better appeared first on Stockhead.