Thursday, 2 March 2023

IPO Wrap: Only five listees are ready to hit the stage this month – but one’s a lithium explorer

by Berkeley Lovelace

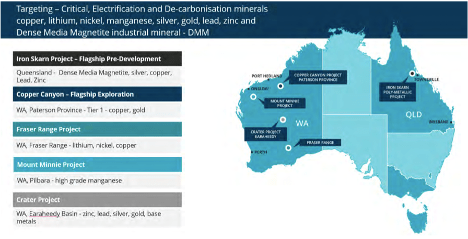

- Tiger Tasman has copper, lithium, nickel, manganese, silver, gold, base metals projects in WA and QLD

- Northstar Energy is looking for hydrocarbon resources in south-west Queensland

- Evergreen is looking for lithium right next door to the Finniss mine in the Northern Territory

It’s slim pickings for IPOs so far this year, so let’s take a look at the five companies lining up to join the bourse in March.

TIGER TASMAN MINERALS (ASX:T1G)

Listing: 3 March

IPO: $8m at $0.20

Tiger Tasman Minerals has projects in WA and QLD focused on copper, lithium, nickel, manganese, silver, gold, base metals and industrial minerals (DMM) essential to the global clean energy transition, decarbonisation and a more sustainable future.

The projects are in proven and prospective jurisdictions including Paterson Province, Fraser Range, Earaheedy Basin, Ashburton and the Townsville region.

They are the Iron Skarn silver-copper-lead-zinc project (QLD), the Copper Canyon copper-gold project (WA), the Fraser Range lithium-nickel-copper project (WA), the Mt Minnie manganese project (WA), and the Crater copper-zinc-lead-silver-gold project (WA).

Listing: 9 March

IPO: $25m at $0.20

The gas company is focussed on the exploration and delineation of hydrocarbon resources at its flagship project, Project Cosmos, in southwest Queensland which is in the under-explored region of the Surat, Eromanga and Adavale basins.

Following its listing on the ASX, NTH will focus on undertaking systematic exploration aimed at increasing the confidence and scale of the existing prospective resource estimated by an independent technical expert at approximately 1,150 (bcf) and 209 (bcf) within the ATP1072 and ATP1098 tenements, respectively.

The company also plans to undertake pilot production testing to further delineate the reservoir characteristics.

Listing: 10 March

IPO: $7m at $0.20

Evergreen’s flagship Bynoe lithium project is adjacent to Core Lithium (ASX:CXO) and its producing Finniss mine in the Northern Territory.

To date the company has completed an Ambient Noise Topography (ANT) Survey and commenced field mapping and stage 2 soil, rock chip and termite mound sampling at the Bynoe project and says the soil sampling has confirmed its view of strong anomalous lithium in soil anomalies along strike from Finniss.

The company has also completed a comprehensive auger program, drilling 1,731 holes at the Kenny lithium project, with results expected shortly after listing.

EG1 also holds the Fortune project – also in the NT.

Listing: 28 March

IPO: $15m at $0.20

Ashby is focused on developing a gold production business in the Charters Towers region in Northern Queensland, and has secured rights to a land package covering over 600km2 which contains historical mines, mineral resources, and a gold processing plant.

The 340Ktpa Blackjack Processing Plant is a conventional Carbon in Pulp (CIP) plant and is located 15 minutes from Charters Towers.

The Far Fanning gold project lies on a permitted Mining Lease with historical production of 47,200oz gold from 664,000t of ore at average 2.2g/t gold. The main historical open pit is only 30m deep and last operated in 2005.

The JORC (2012) resource was updated in 2021 to 2.55Mt at 1.8g/t for 147,000oz gold.

The company is presently undertaking programs to improve the confidence in the Far Fanning resource estimate through verification and infill drilling which will support a further resource update, feasibility study and commencement of mining operations.

Listing: 29 March

IPO: $8m at $0.25

The critical metals company has projects in Canada and Western Australia which are prospective for nickel, copper, PGE and lithium.

In Canada, projects include the William Lake nickel project and Jenpeg lithium project in Manitoba and the Ignace lithium project in Ontario.

William Lake is the flagship, located in the world-class Thompson Nickel Belt and includes historic results of 17.09m at 1.48% nickel and 12.7m at 1.86% nickel.

In Western Australia, the company holds lithium and REE projects near Marble Bar and in the Gascoyne where reconnaissance work is underway.

What about April?

WESTERN AUSTRALIA ENERGY RESOURCES (ASX:WER)

Listing: 12 April

IPO: $5m at $0.20

WER is exploring and developing its its Jimberlana Project on the Yilgarn Craton for battery metals.

The company owns two granted exploration licences covering 253km2 and a further seven exploration licence applications covering an additional 687km2, with the focus on 75km of strike of the lightly explored Jimberlana Dyke which hosts a nickel laterite deposit at Bronzite Ridge and historical drill-holes reporting nickel sulphide mineralisation.

The plan is to drill the Bronzite Ridge nickel laterite deposit with a view to increasing the resource confidence and obtaining samples for metallurgical test-work.

The post IPO Wrap: Only five listees are ready to hit the stage this month – but one’s a lithium explorer appeared first on Stockhead.