Wednesday, 8 March 2023

High Voltage: Tesla’s plan for a US$25k electric vehicle ‘could break the car market’

by Berkeley Lovelace

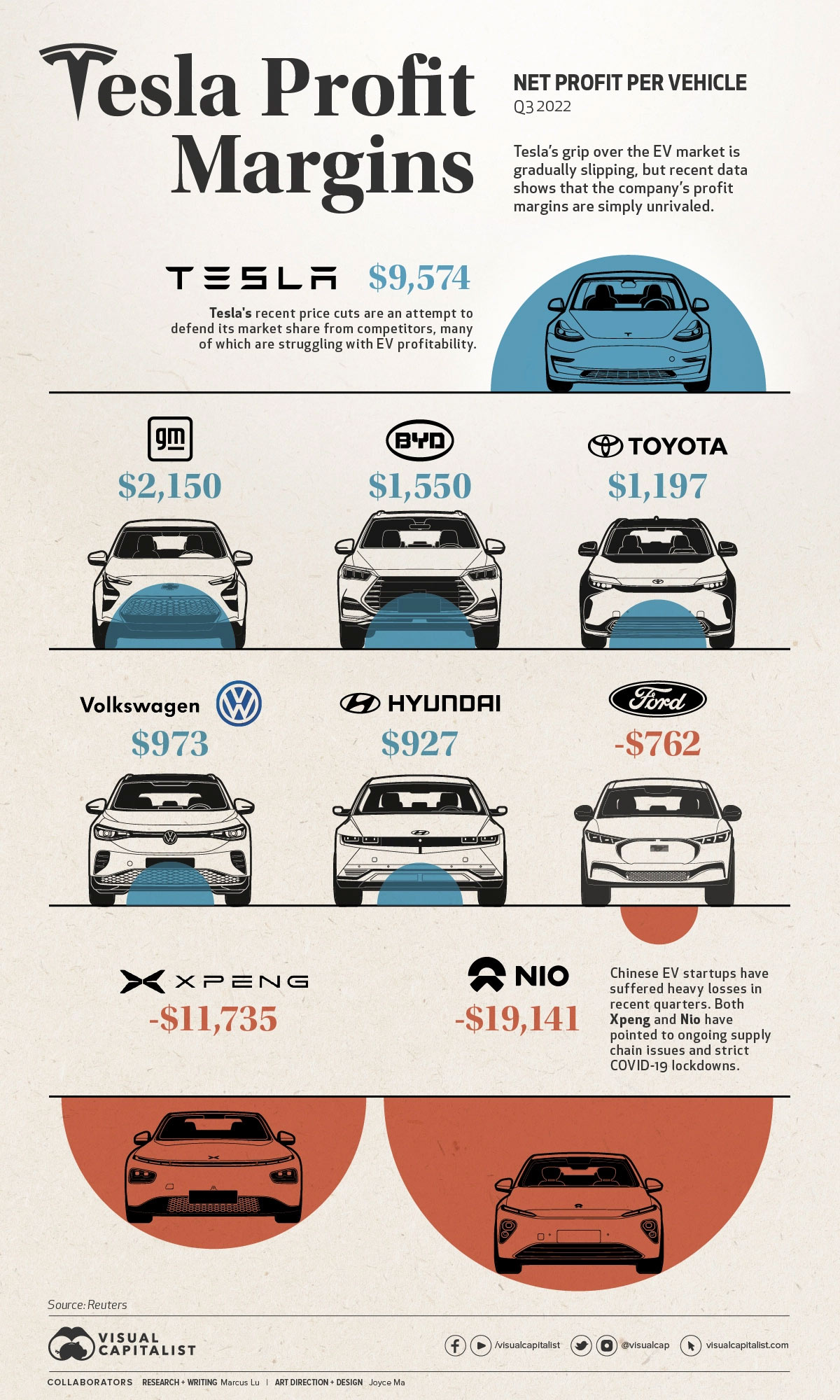

- Tesla already has profit margins far bigger than its competitors

- It plans to cut manufacturing costs for its next generation of vehicles by a further 50%

- “If Tesla can sell its new model for US$25,000, that will be revolutionary”: Wood Mackenzie

Our High Voltage column wraps all the news driving ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, manganese, magnesium, and vanadium.

High prices have been one of the main impediments to universal electric vehicle uptake.

While the cost/price gap between EV and ICE is steadily closing — thanks to falling battery costs (the most expensive part of an EV) and more streamlined and scaled manufacturing processes – many car makers are still taking a haircut on each EV they sell.

This is where Tesla stands head and shoulders above the rest, according to recent data from Visual Capitalist:

Tesla is an EV pioneer with a profit margin miles bigger than its competitors, including incumbents like GM, Ford and VW.

Tesla’s net profit margins were far ahead of the competition, bringing in $9.5K/car sold while GM, the closest competitor, had a net profit margin of just over $2K/car. $TSLA has created room to lower their car prices which could squeeze less-profitable #EV manufacturers out. pic.twitter.com/8MuPmSjmp4

— Wilshire Phoenix (@WilshirePhoenix) March 6, 2023

A US$25k EV?

One of the key takeaways from Tesla’s Investor Day presentation last week was a plan to cut manufacturing costs for its next generation of vehicles by a further 50%.

The new processes are not going to be used for Tesla’s current model line, but for a new car that company currently refers to only as “the next-gen vehicle”.

It is widely expected to be a small car: a mass-market entry-level EV that would sell for significantly less than the US$43,490 price of a basic Model 3, says Ram Chandrasekaran, Wood Mackenzie’s head of road transportation.

A 50% cost reduction will have a huge impact on sales of EVs.

“If Tesla can sell its new model for US$25,000, that will be revolutionary,” Chandrasekaran says.

“It will break the car market.”

With about US$22 billion cash at the end of last year, Tesla is well positioned to achieve the next phase of its growth, but Chandrasekaran cautions that its ambitions still present daunting challenges.

“It has grown to a company selling one million-plus cars a year, but it is looking at an enormous step beyond that,” he says.

“Now it wants to get to four or five million, and more, and only a handful of companies have ever done that.

Elon Musk’s goal of 20 million vehicles a year would give Tesla twice the production of Toyota or VW at their respective peaks, Chandrasekaran says.

“Musk’s record as an entrepreneur is undeniably hit-and-miss. But given the scale of his hits, it would seem rash to bet that he will fail.”

Here’s how a basket of ASX stocks with exposure to lithium, cobalt, graphite, nickel, rare earths, magnesium, manganese, and vanadium is performing>>>

Battery metals stocks missing from our list? Shoot a mail to reuben@stockhead.com.au.

| CODE | COMPANY | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | PRICE | MARKET CAP |

|---|---|---|---|---|---|---|---|

| RXL | Rox Resources | 55% | 22% | -13% | -44% | 0.225 | $50,479,709 |

| ARN | Aldoro Resources | 44% | 2% | -15% | -36% | 0.23 | $25,969,833 |

| SRN | Surefire Rescs NL | 29% | 29% | 29% | 38% | 0.018 | $23,720,452 |

| ASO | Aston Minerals Ltd | 26% | 30% | 50% | -22% | 0.125 | $133,623,712 |

| LTR | Liontown Resources | 26% | 10% | -6% | 7% | 1.655 | $3,781,341,969 |

| ENT | Enterprise Metals | 25% | 11% | 11% | -29% | 0.01 | $5,640,646 |

| SRZ | Stellar Resources | 20% | 0% | -20% | -54% | 0.012 | $12,055,571 |

| AOA | Ausmon Resorces | 20% | 0% | -33% | -14% | 0.006 | $5,815,736 |

| FG1 | Flynngold | 19% | -20% | -17% | -52% | 0.075 | $7,921,262 |

| TKM | Trek Metals Ltd | 19% | 1% | 14% | -3% | 0.075 | $26,567,991 |

| EMH | European Metals Hldg | 18% | 3% | -3% | -42% | 0.7 | $88,198,188 |

| PVT | Pivotal Metals Ltd | 18% | 24% | 57% | -18% | 0.047 | $22,203,840 |

| CHR | Charger Metals | 17% | -16% | -30% | -49% | 0.345 | $16,611,460 |

| HAS | Hastings Tech Met | 16% | -21% | -51% | -54% | 2.63 | $337,155,922 |

| WKT | Walkabout Resources | 16% | -4% | -36% | -45% | 0.11 | $67,289,010 |

| CY5 | Cygnus Metals Ltd | 15% | -26% | 28% | 93% | 0.3575 | $67,114,087 |

| WA1 | Wa1Resourcesltd | 15% | -17% | 761% | 545% | 1.42 | $49,289,845 |

| E25 | Element 25 Ltd | 15% | -5% | 20% | -19% | 0.81 | $156,177,502 |

| VMC | Venus Metals Cor Ltd | 15% | 3% | -14% | -14% | 0.155 | $26,711,802 |

| TMB | Tambourahmetals | 14% | 9% | -17% | -44% | 0.12 | $4,531,186 |

| MTM | Mtmongerresources | 14% | 54% | -23% | -27% | 0.12 | $6,419,331 |

| GT1 | Greentechnology | 14% | -17% | 2% | -9% | 0.735 | $139,239,027 |

| GW1 | Greenwing Resources | 14% | -15% | -14% | -12% | 0.25 | $36,323,422 |

| LIN | Lindian Resources | 14% | 14% | 2% | 762% | 0.25 | $263,995,691 |

| PSC | Prospect Res Ltd | 13% | 65% | 122% | 414% | 0.215 | $97,074,487 |

| AXN | Alliance Nickel Ltd | 12% | 5% | -12% | 86% | 0.11 | $64,250,628 |

| OM1 | Omnia Metals Group | 12% | 62% | 83% | 57% | 0.275 | $8,300,687 |

| GRE | Greentechmetals | 11% | 30% | -38% | -39% | 0.15 | $4,520,600 |

| RBX | Resource B | 11% | 50% | 25% | -23% | 0.15 | $8,560,475 |

| MIN | Mineral Resources. | 11% | 0% | 46% | 84% | 88.27 | $17,122,031,772 |

| ASN | Anson Resources Ltd | 11% | -13% | -30% | 68% | 0.21 | $247,661,386 |

| DEV | Devex Resources Ltd | 10% | -5% | -31% | -29% | 0.275 | $105,671,894 |

| SYA | Sayona Mining Ltd | 10% | 1% | -8% | 90% | 0.2475 | $2,043,375,359 |

| EMT | Emetals Limited | 10% | 0% | -48% | -35% | 0.011 | $8,500,000 |

| VTM | Victory Metals Ltd | 10% | 10% | -15% | 42% | 0.22 | $11,807,113 |

| SBR | Sabre Resources | 9% | -13% | -42% | -13% | 0.035 | $10,784,989 |

| VRC | Volt Resources Ltd | 9% | -8% | -48% | 0% | 0.012 | $47,273,087 |

| NWM | Norwest Minerals | 9% | -43% | -40% | -36% | 0.036 | $7,773,759 |

| CHN | Chalice Mining Ltd | 8% | 2% | 50% | -13% | 6.54 | $2,518,431,728 |

| AKE | Allkem Limited | 8% | -7% | -14% | 21% | 12.1 | $7,824,064,715 |

| LML | Lincoln Minerals | 8% | -32% | 279% | 279% | 0.026 | $14,949,576 |

| ENV | Enova Mining Limited | 8% | 8% | -19% | -35% | 0.013 | $5,082,081 |

| CXO | Core Lithium | 8% | -6% | -33% | 6% | 1.005 | $1,892,117,130 |

| MRC | Mineral Commodities | 8% | 3% | -15% | -46% | 0.067 | $44,944,636 |

| LPI | Lithium Pwr Int Ltd | 8% | -17% | -46% | -45% | 0.35 | $217,038,658 |

| WML | Woomera Mining Ltd | 8% | -13% | -17% | -17% | 0.014 | $12,430,096 |

| S32 | South32 Limited | 8% | 0% | 11% | -11% | 4.615 | $21,572,748,837 |

| BHP | BHP Group Limited | 8% | -1% | 29% | 8% | 47.895 | $245,135,056,705 |

| NTU | Northern Min Ltd | 7% | 13% | 10% | -10% | 0.045 | $233,571,712 |

| RNU | Renascor Res Ltd | 7% | -12% | 25% | -20% | 0.225 | $571,366,687 |

| GL1 | Globallith | 7% | -24% | -14% | -1% | 1.625 | $345,340,675 |

| LRS | Latin Resources Ltd | 7% | 2% | 2% | 201% | 0.1175 | $264,198,590 |

| QPM | Queensland Pacific | 7% | 3% | -29% | -32% | 0.1025 | $183,366,532 |

| ALY | Alchemy Resource Ltd | 7% | -6% | -24% | 23% | 0.016 | $18,849,220 |

| RVT | Richmond Vanadium | 7% | 0% | 0% | 0% | 0.4 | $34,914,161 |

| EFE | Eastern Resources | 6% | 0% | -41% | -65% | 0.017 | $21,113,090 |

| LLI | Loyal Lithium Ltd | 6% | -29% | -4% | 40% | 0.35 | $20,821,500 |

| MOH | Moho Resources | 6% | -14% | -45% | -59% | 0.018 | $3,530,257 |

| IGO | IGO Limited | 6% | -5% | 5% | 12% | 13.65 | $10,450,295,819 |

| LKE | Lake Resources | 6% | -18% | -49% | -38% | 0.6175 | $915,864,333 |

| GED | Golden Deeps | 6% | -14% | -37% | -5% | 0.0095 | $10,397,040 |

| WMG | Western Mines | 6% | 19% | 36% | 12% | 0.19 | $7,796,175 |

| BUR | Burleyminerals | 6% | -3% | 138% | 138% | 0.285 | $16,888,947 |

| GSM | Golden State Mining | 5% | -15% | -28% | -51% | 0.039 | $4,329,526 |

| WC8 | Wildcat Resources | 5% | 2% | 9% | -2% | 0.0295 | $19,198,659 |

| QXR | Qx Resources Limited | 5% | -13% | 38% | -15% | 0.04 | $36,771,355 |

| PGM | Platina Resources | 5% | -9% | -19% | -59% | 0.021 | $11,840,426 |

| A11 | Atlantic Lithium | 5% | -9% | 0% | 0% | 0.665 | $399,789,496 |

| SYR | Syrah Resources | 5% | -8% | 10% | 40% | 1.8475 | $1,247,401,985 |

| TON | Triton Min Ltd | 5% | -18% | 23% | 19% | 0.0345 | $47,014,662 |

| NIC | Nickel Industries | 4% | -7% | 12% | -38% | 1.0025 | $3,084,742,418 |

| OCN | Oceanalithiumlimited | 4% | -1% | -39% | 0% | 0.36 | $13,109,040 |

| 1AE | Auroraenergymetals | 4% | -20% | -59% | 0% | 0.12 | $14,730,502 |

| ILU | Iluka Resources | 4% | -4% | 8% | 2% | 10.65 | $4,519,140,122 |

| GBR | Greatbould Resources | 4% | 16% | -5% | -31% | 0.1 | $41,803,601 |

| AX8 | Accelerate Resources | 4% | -4% | -26% | -42% | 0.026 | $9,817,646 |

| S2R | S2 Resources | 4% | -13% | 0% | -22% | 0.14 | $55,355,605 |

| RDT | Red Dirt Metals Ltd | 4% | -14% | -29% | -21% | 0.42 | $177,962,996 |

| LOT | Lotus Resources Ltd | 4% | -6% | -24% | -18% | 0.2125 | $279,350,331 |

| GLN | Galan Lithium Ltd | 4% | 5% | -6% | -15% | 1.16 | $359,091,024 |

| WR1 | Winsome Resources | 4% | -5% | 692% | 480% | 2.06 | $323,572,849 |

| LPM | Lithium Plus | 4% | -23% | -50% | 0% | 0.295 | $15,447,701 |

| KOB | Kobaresourceslimited | 3% | -14% | -12% | 0% | 0.15 | $11,400,000 |

| EVG | Evion Group NL | 3% | -13% | -30% | -45% | 0.061 | $17,043,170 |

| PLL | Piedmont Lithium Inc | 3% | -6% | 6% | 15% | 0.92 | $413,303,945 |

| MRR | Minrex Resources Ltd | 3% | -14% | -35% | -47% | 0.031 | $34,715,760 |

| EVR | Ev Resources Ltd | 3% | 3% | -47% | -70% | 0.0155 | $14,039,761 |

| L1M | Lightning Minerals | 3% | -18% | 0% | 0% | 0.155 | $5,963,400 |

| LRV | Larvottoresources | 3% | -3% | -24% | -8% | 0.17 | $11,433,303 |

| LLL | Leolithiumlimited | 3% | -14% | -13% | 0% | 0.52 | $522,928,163 |

| FRB | Firebird Metals | 3% | 3% | -5% | -38% | 0.175 | $12,422,866 |

| POS | Poseidon Nick Ltd | 3% | -5% | -29% | -59% | 0.037 | $125,949,143 |

| LEL | Lithenergy | 3% | -20% | -23% | -19% | 0.74 | $44,210,250 |

| PGD | Peregrine Gold | 2% | -10% | -32% | -15% | 0.44 | $17,060,511 |

| PVW | PVW Res Ltd | 2% | -22% | -67% | -84% | 0.09 | $8,861,724 |

| DVP | Develop Global Ltd | 2% | -10% | 40% | -8% | 3.17 | $540,236,418 |

| JRL | Jindalee Resources | 2% | 6% | 2% | -16% | 2.505 | $151,480,470 |

| CAI | Calidus Resources | 2% | -11% | -59% | -70% | 0.235 | $107,689,956 |

| ETM | Energy Transition | 2% | -4% | -25% | -17% | 0.048 | $66,431,457 |

| PMT | Patriotbatterymetals | 2% | -18% | 0% | 0% | 1.5 | $358,168,409 |

| REE | Rarex Limited | 2% | -20% | -14% | -51% | 0.051 | $29,548,715 |

| EV1 | Evolutionenergy | 2% | -16% | -4% | -43% | 0.27 | $39,915,625 |

| AZS | Azure Minerals | 2% | -6% | 51% | -20% | 0.295 | $98,582,880 |

| PEK | Peak Rare Earths Ltd | 2% | 23% | 23% | -15% | 0.605 | $128,112,144 |

| AAJ | Aruma Resources Ltd | 2% | -15% | -2% | -26% | 0.064 | $10,359,459 |

| EUR | European Lithium Ltd | 1% | -16% | -17% | -31% | 0.069 | $99,997,503 |

| SCN | Scorpion Minerals | 1% | -13% | -16% | -1% | 0.07 | $24,199,433 |

| WIN | Widgienickellimited | 1% | 6% | 23% | -1% | 0.35 | $90,364,618 |

| MNS | Magnis Energy Tech | 1% | -13% | -29% | -17% | 0.355 | $339,616,019 |

| NVX | Novonix Limited | 1% | -16% | -26% | -70% | 1.52 | $744,765,172 |

| PNN | Power Minerals Ltd | 1% | -18% | -24% | 0% | 0.41 | $29,982,025 |

| TVN | Tivan Limited | 1% | 1% | -26% | 35% | 0.085 | $118,015,549 |

| BM8 | Battery Age Minerals | 1% | 4% | -3% | 13% | 0.485 | $35,624,718 |

| ARL | Ardea Resources Ltd | 1% | -23% | -34% | -19% | 0.555 | $96,899,066 |

| AGY | Argosy Minerals Ltd | 1% | 1% | 66% | 120% | 0.705 | $1,025,217,474 |

| MCR | Mincor Resources NL | 1% | -21% | -41% | -45% | 1.2425 | $667,229,874 |

| VUL | Vulcan Energy | 0% | -13% | -22% | -31% | 6.22 | $900,773,690 |

| VIA | Viagold Rare Earth | 0% | 0% | 0% | 0% | 2 | $166,624,808 |

| INF | Infinity Lithium | 0% | -24% | -42% | -29% | 0.11 | $53,198,091 |

| NWC | New World Resources | 0% | -19% | 57% | -19% | 0.047 | $96,852,634 |

| GSR | Greenstone Resources | 0% | -24% | -66% | -41% | 0.022 | $27,776,616 |

| HNR | Hannans Ltd | 0% | -29% | -43% | -64% | 0.012 | $35,419,863 |

| CZN | Corazon Ltd | 0% | -14% | -10% | -42% | 0.019 | $11,596,281 |

| AVZ | AVZ Minerals Ltd | 0% | 0% | 0% | -15% | 0.78 | $2,752,409,203 |

| RLC | Reedy Lagoon Corp. | 0% | -11% | -50% | -68% | 0.008 | $4,533,757 |

| HXG | Hexagon Energy | 0% | -18% | -13% | -75% | 0.014 | $7,180,823 |

| QEM | QEM Limited | 0% | -9% | -17% | 21% | 0.2 | $26,352,996 |

| ADV | Ardiden Ltd | 0% | 0% | 0% | -42% | 0.007 | $18,818,347 |

| SRI | Sipa Resources Ltd | 0% | -13% | -43% | -50% | 0.027 | $6,160,270 |

| BSX | Blackstone Ltd | 0% | -6% | -26% | -68% | 0.145 | $68,640,845 |

| AVL | Aust Vanadium Ltd | 0% | -3% | -26% | -16% | 0.032 | $139,636,007 |

| BRB | Breaker Res NL | 0% | -5% | 31% | 20% | 0.275 | $89,881,227 |

| FFX | Firefinch Ltd | 0% | 0% | 0% | -17% | 0.2 | $236,569,315 |

| ATM | Aneka Tambang | 0% | 0% | -4% | 0% | 1.1 | $1,434,014 |

| 1MC | Morella Corporation | 0% | -21% | -56% | -54% | 0.011 | $67,084,385 |

| SLZ | Sultan Resources Ltd | 0% | -19% | -48% | -68% | 0.052 | $4,330,788 |

| MQR | Marquee Resource Ltd | 0% | -12% | -55% | -71% | 0.03 | $9,489,018 |

| BYH | Bryah Resources Ltd | 0% | -5% | -25% | -56% | 0.021 | $5,906,323 |

| DTM | Dart Mining NL | 0% | -6% | -56% | -46% | 0.046 | $7,158,546 |

| EMS | Eastern Metals | 0% | -14% | -37% | -67% | 0.069 | $2,656,380 |

| CTN | Catalina Resources | 0% | -40% | -25% | -65% | 0.006 | $8,669,408 |

| KZR | Kalamazoo Resources | 0% | -17% | -26% | -41% | 0.17 | $24,720,197 |

| CMO | Cosmometalslimited | 0% | -7% | -14% | -19% | 0.125 | $3,188,750 |

| RR1 | Reach Resources Ltd | 0% | 0% | -17% | -38% | 0.005 | $11,887,753 |

| KAI | Kairos Minerals Ltd | 0% | -5% | -32% | -14% | 0.019 | $37,317,776 |

| ODE | Odessa Minerals Ltd | 0% | -25% | -23% | -8% | 0.012 | $8,483,461 |

| XTC | Xantippe Res Ltd | 0% | 20% | -33% | -14% | 0.006 | $52,900,498 |

| ABX | ABX Group Limited | 0% | -7% | -21% | 0% | 0.13 | $29,066,806 |

| RR1 | Reach Resources Ltd | 0% | 0% | -17% | -38% | 0.005 | $11,887,753 |

| DM1 | Desert Metals | 0% | -20% | -57% | -54% | 0.16 | $11,590,572 |

| M24 | Mamba Exploration | 0% | -39% | 25% | -22% | 0.125 | $7,622,917 |

| VHM | Vhmlimited | 0% | -8% | 0% | 0% | 0.88 | $125,531,334 |

| OZL | OZ Minerals | 0% | 0% | 7% | 5% | 27.94 | $9,394,447,048 |

| NVA | Nova Minerals Ltd | -1% | -16% | -41% | -10% | 0.53 | $111,771,581 |

| BC8 | Black Cat Syndicate | -1% | -5% | 5% | -31% | 0.385 | $106,460,781 |

| SGQ | St George Min Ltd | -1% | -9% | 165% | 64% | 0.069 | $58,616,988 |

| VR8 | Vanadium Resources | -1% | -19% | -13% | -11% | 0.067 | $31,971,217 |

| ESS | Essential Metals Ltd | -2% | -6% | -1% | 39% | 0.4875 | $132,445,514 |

| PAT | Patriot Lithium | -2% | -26% | 0% | 0% | 0.32 | $19,404,001 |

| PLS | Pilbara Min Ltd | -2% | -13% | 4% | 47% | 4.135 | $12,291,855,428 |

| ASM | Ausstratmaterials | -2% | -36% | -50% | -81% | 1.57 | $273,396,572 |

| GAL | Galileo Mining Ltd | -2% | -13% | -30% | 244% | 0.74 | $148,218,695 |

| CTM | Centaurus Metals Ltd | -2% | -17% | -14% | -26% | 0.96 | $410,022,022 |

| VML | Vital Metals Limited | -2% | 2% | -38% | -50% | 0.0235 | $122,041,444 |

| BUX | Buxton Resources Ltd | -2% | 19% | 91% | 124% | 0.22 | $31,896,681 |

| ZNC | Zenith Minerals Ltd | -2% | -6% | -30% | -36% | 0.22 | $77,375,330 |

| EGR | Ecograf Limited | -2% | -18% | -53% | -65% | 0.205 | $96,821,694 |

| AR3 | Austrare | -2% | -33% | -41% | -74% | 0.205 | $19,040,310 |

| EMC | Everest Metals Corp | -2% | -10% | -18% | -48% | 0.082 | $8,727,515 |

| STK | Strickland Metals | -3% | -3% | -26% | -36% | 0.039 | $60,642,222 |

| LIT | Lithium Australia | -3% | -20% | -39% | -63% | 0.039 | $47,626,475 |

| CNB | Carnaby Resource Ltd | -3% | -4% | 31% | -32% | 1.085 | $161,461,592 |

| PAM | Pan Asia Metals | -3% | -3% | -16% | -32% | 0.36 | $52,868,012 |

| JRV | Jervois Global Ltd | -3% | -28% | -64% | -75% | 0.18 | $384,663,278 |

| STM | Sunstone Metals Ltd | -3% | 10% | -21% | -56% | 0.034 | $89,095,178 |

| AKN | Auking Mining Ltd | -3% | -36% | -23% | -61% | 0.067 | $11,418,535 |

| MMC | Mitremining | -3% | -4% | 136% | 51% | 0.295 | $10,615,605 |

| AZL | Arizona Lithium Ltd | -3% | -17% | -32% | -59% | 0.058 | $144,107,774 |

| INR | Ioneer Ltd | -3% | -17% | -44% | -32% | 0.3575 | $797,368,541 |

| CMX | Chemxmaterials | -3% | -3% | -26% | -22% | 0.14 | $7,092,558 |

| LPD | Lepidico Ltd | -4% | -10% | -55% | -58% | 0.0135 | $99,291,032 |

| PAN | Panoramic Resources | -4% | -21% | -37% | -53% | 0.135 | $276,873,391 |

| ITM | Itech Minerals Ltd | -4% | -22% | -17% | -41% | 0.26 | $30,402,726 |

| OMH | OM Holdings Limited | -4% | -11% | 22% | -19% | 0.755 | $565,046,853 |

| NC1 | Nicoresourceslimited | -4% | -7% | -34% | -27% | 0.5275 | $45,940,814 |

| BOA | Boadicea Resources | -4% | -14% | -28% | -54% | 0.09 | $7,029,281 |

| IXR | Ionic Rare Earths | -4% | -4% | -22% | -40% | 0.0335 | $130,221,462 |

| VMS | Venture Minerals | -4% | -12% | -15% | -44% | 0.022 | $42,400,982 |

| CNJ | Conico Ltd | -5% | -16% | -76% | -12% | 0.0105 | $14,549,681 |

| IPX | Iperionx Limited | -5% | 1% | -2% | -16% | 0.84 | $146,508,648 |

| BNR | Bulletin Res Ltd | -5% | -13% | -25% | -30% | 0.105 | $29,359,110 |

| WCN | White Cliff Min Ltd | -5% | -13% | -60% | -60% | 0.0105 | $8,232,571 |

| CDT | Castle Minerals | -5% | -9% | -28% | -59% | 0.021 | $21,988,846 |

| MLX | Metals X Limited | -5% | -20% | 0% | -53% | 0.3 | $267,643,490 |

| RAS | Ragusa Minerals Ltd | -5% | -14% | -57% | 79% | 0.095 | $13,974,681 |

| BKT | Black Rock Mining | -5% | -17% | 2% | -41% | 0.1375 | $137,618,417 |

| AS2 | Askarimetalslimited | -5% | -16% | 59% | 44% | 0.54 | $26,481,178 |

| LNR | Lanthanein Resources | -5% | -18% | -69% | -31% | 0.018 | $20,188,360 |

| LNR | Lanthanein Resources | -5% | -18% | -69% | -31% | 0.018 | $20,188,360 |

| CAE | Cannindah Resources | -5% | -26% | -22% | -49% | 0.175 | $98,346,492 |

| IDA | Indiana Resources | -5% | -12% | -25% | -16% | 0.052 | $27,065,060 |

| LMG | Latrobe Magnesium | -5% | -9% | -17% | -25% | 0.069 | $113,629,976 |

| ADD | Adavale Resource Ltd | -6% | -15% | -51% | -50% | 0.017 | $8,831,944 |

| TAR | Taruga Minerals | -6% | -11% | -43% | -48% | 0.017 | $11,296,429 |

| ARU | Arafura Rare Earths | -6% | -7% | 66% | 183% | 0.565 | $1,172,000,062 |

| CLA | Celsius Resource Ltd | -6% | -6% | 23% | -27% | 0.016 | $29,715,265 |

| AQD | Ausquest Limited | -6% | -6% | -6% | -6% | 0.016 | $13,202,388 |

| CRR | Critical Resources | -6% | -16% | 10% | -40% | 0.046 | $74,953,479 |

| AM7 | Arcadia Minerals | -6% | 5% | -13% | 2% | 0.225 | $10,507,026 |

| RAG | Ragnar Metals Ltd | -6% | -6% | -61% | -44% | 0.015 | $5,687,773 |

| JMS | Jupiter Mines. | -6% | -2% | 15% | -4% | 0.225 | $450,567,938 |

| BCA | Black Canyon Limited | -6% | -12% | -15% | -15% | 0.22 | $10,201,663 |

| TEM | Tempest Minerals | -7% | -20% | -49% | -7% | 0.0215 | $11,649,566 |

| TMT | Technology Metals | -7% | -11% | -20% | -22% | 0.28 | $58,750,876 |

| FTL | Firetail Resources | -7% | 0% | -43% | 0% | 0.14 | $9,100,000 |

| COB | Cobalt Blue Ltd | -7% | -28% | -51% | -28% | 0.39 | $144,322,437 |

| MAN | Mandrake Res Ltd | -7% | -4% | 14% | 6% | 0.05 | $31,109,516 |

| PUR | Pursuit Minerals | -7% | 9% | 92% | 19% | 0.025 | $28,563,746 |

| KNI | Kunikolimited | -7% | -21% | -45% | -36% | 0.435 | $22,002,228 |

| ESR | Estrella Res Ltd | -8% | -20% | -14% | -57% | 0.012 | $22,253,578 |

| IMI | Infinitymining | -8% | -20% | -10% | 6% | 0.18 | $13,383,706 |

| IG6 | Internationalgraphit | -8% | -4% | -28% | 0% | 0.24 | $21,117,146 |

| OD6 | Od6Metalsltd | -8% | -26% | 33% | 0% | 0.24 | $13,478,797 |

| ARR | American Rare Earths | -8% | -13% | 0% | -43% | 0.23 | $100,435,680 |

| LYC | Lynas Rare Earths | -8% | -21% | -13% | -32% | 7.325 | $6,742,792,435 |

| PBL | Parabellumresources | -8% | -24% | -7% | 89% | 0.34 | $18,605,650 |

| LEG | Legend Mining | -8% | -19% | 19% | -32% | 0.044 | $121,225,972 |

| FGR | First Graphene Ltd | -9% | -2% | -23% | -42% | 0.096 | $55,436,168 |

| AML | Aeon Metals Ltd. | -9% | -25% | -30% | -58% | 0.021 | $23,024,413 |

| KOR | Korab Resources | -9% | -9% | -25% | -53% | 0.021 | $7,708,050 |

| AOU | Auroch Minerals Ltd | -9% | -19% | -19% | -53% | 0.052 | $23,103,637 |

| CWX | Carawine Resources | -9% | -21% | -9% | -57% | 0.091 | $17,713,572 |

| KGD | Kula Gold Limited | -9% | -26% | -17% | -53% | 0.02 | $7,224,238 |

| RGL | Riversgold | -9% | -23% | -44% | -18% | 0.02 | $17,963,887 |

| THR | Thor Energy PLC | -9% | -17% | -50% | -64% | 0.005 | $7,378,064 |

| AZI | Altamin Limited | -9% | -8% | -26% | 3% | 0.07 | $28,203,606 |

| MEK | Meeka Metals Limited | -9% | -29% | -39% | -22% | 0.04 | $43,771,966 |

| DRE | Dreadnought Resources Ltd | -9% | -30% | -46% | 75% | 0.07 | $250,323,345 |

| BMM | Balkanminingandmin | -9% | -27% | 86% | 28% | 0.345 | $15,446,345 |

| NMT | Neometals Ltd | -10% | -8% | -48% | -51% | 0.725 | $414,555,882 |

| MRD | Mount Ridley Mines | -10% | -10% | -25% | -53% | 0.0045 | $31,139,531 |

| TLG | Talga Group Ltd | -10% | -14% | 6% | 4% | 1.485 | $545,603,271 |

| IPT | Impact Minerals | -10% | -14% | 13% | -29% | 0.009 | $22,332,335 |

| RMX | Red Mount Min Ltd | -10% | -25% | -25% | -44% | 0.0045 | $10,223,330 |

| MLS | Metals Australia | -10% | -13% | -10% | -49% | 0.045 | $27,923,665 |

| LSR | Lodestar Minerals | -10% | -10% | -36% | -65% | 0.0045 | $6,953,749 |

| CZL | Cons Zinc Ltd | -10% | 0% | -28% | -36% | 0.018 | $9,405,977 |

| SUM | Summitminerals | -10% | -10% | -29% | 0% | 0.135 | $3,214,582 |

| KTA | Krakatoa Resources | -10% | -13% | -44% | -13% | 0.035 | $12,754,267 |

| AUZ | Australian Mines Ltd | -10% | -30% | -51% | -77% | 0.039 | $21,714,697 |

| FRS | Forrestaniaresources | -11% | -22% | -29% | -68% | 0.125 | $7,002,500 |

| GRL | Godolphin Resources | -11% | -30% | -29% | -57% | 0.063 | $7,516,460 |

| KFM | Kingfisher Mining | -11% | -47% | -50% | 23% | 0.27 | $14,771,625 |

| A8G | Australasian Metals | -12% | -19% | -44% | -68% | 0.15 | $6,175,574 |

| EMN | Euromanganese | -13% | -20% | -20% | -38% | 0.24 | $64,918,944 |

| NKL | Nickelxltd | -14% | -14% | -53% | -56% | 0.064 | $5,184,833 |

| TKL | Traka Resources | -14% | -14% | -14% | -45% | 0.006 | $4,336,647 |

| G88 | Golden Mile Res Ltd | -14% | -18% | -49% | -69% | 0.017429 | $3,565,877 |

| PTR | Petratherm Ltd | -15% | -16% | -10% | 49% | 0.061 | $13,934,571 |

| WC1 | Westcobarmetals | -16% | -19% | -33% | -7% | 0.13 | $13,389,480 |

| AVW | Avira Resources Ltd | -17% | -17% | -38% | -50% | 0.0025 | $5,334,475 |

| CLZ | Classic Min Ltd | -17% | -69% | -84% | -98% | 0.0025 | $2,532,188 |

| GCM | Green Critical Min | -18% | -22% | -2% | 13% | 0.014 | $15,783,658 |

| HRE | Heavy Rare Earths | -18% | -18% | -39% | 0% | 0.115 | $6,841,112 |

| PNT | Panthermetalsltd | -19% | -33% | -28% | -46% | 0.13 | $3,997,500 |

| PRL | Province Resources | -21% | -25% | -56% | -60% | 0.042 | $63,800,630 |

| M2R | Miramar | -27% | -36% | -55% | -68% | 0.052 | $3,675,451 |

WEEKLY SMALL CAP STANDOUTS

SRN says a new exploration target of 682Mt to 1190Mt @ 0.2% to 0.43% vanadium propels its Victory Bore project in WA to “world class status”.

When added to the current 321Mt @ 0.39% resource, the exploration target boosts the project’s potential to 1003Mt-1,511Mt @ 0.2% to 0.43% V205, “making it world class and potentially one of the largest vanadium resources in the world”.

For reference, advanced vanadium stocks AVL (ASX:AVL), Vanadium Resources (ASX:VR8), and Technology Metals (ASX:TMT) have respective resources of 239Mt at 0.73%, 680Mt at 0.70%, and 153.7Mt at 0.8%.

An update on the PFS – a look at the economics of building a project – is due in the next few weeks, SRN says.

“The extensive linear continuity of the Victory Bore Titanomagnetite and high vanadium grades where we have drilled provide a compelling prediction of the total scale of this vanadium project,” managing director Paul Burton says.

“When proven, it would place this project as one the world’s largest undeveloped vanadium resources and given its good location only 400km from port and proximal to existing infrastructure means it is a hugely valuable asset for Surefire shareholders.”

The WA explorer has a portfolio of battery metals/critical minerals projects covering lithium, nickel and ultra-rare rubidium.

The stock has crept higher on no news over the past week or so, attracting a ‘please explain’ from the ASX.

In response the company says volatility coincided with exploration drilling at the Narndee nickel-PGE project.

“Assays for Narndee have been expedited, with resulted expected in the next two weeks,” it says.

“As announced on 31 October 2022, the company has previously disclosed its intention to secure a suitable JV partner or offtake partner for its Niobe [lithium rubidium] project.

“Preliminary discussions/due diligence is currently underway however there have been no further developments at this stage.”

ARN recently released a maiden resource for the ‘Niobe’ lithium-rubidium project of 4.6Mt @ 0.17% Rb2O and 0.07% Li2O, equivalent to 8,060t of Rb2O and 3,080t of Li2O.

Mineralisation remains ‘open’ at shallow depths.

A new drilling program is planned to grow the resource size and upgrade the classification.

It is also pushing ahead with development approvals and a scoping study, the first proper look at the economics of building a mine.

The post High Voltage: Tesla’s plan for a US$25k electric vehicle ‘could break the car market’ appeared first on Stockhead.