Thursday, 30 November 2023

A national healthcare services company builds an omnichannel payments strategy for retail pharmacy customers

by Earn Media

Situation

As a national healthcare services company, this client wanted to develop a payments acceptance and processing strategy that brought value to independent retail pharmacy customers—but they didn’t quite know where to start. They partnered with Glenbrook to execute a two-phase project that would help them understand the options available to their organization and select the right path forward.

In parallel, this client also wanted to educate their team on the payments industry to help them better understand how recommendations could be implemented. So, they enlisted the help of Glenbrook’s experts to lead a Payments Boot Camp™ among business partners.

Approach

In Phase 1 of the project, we evaluated strategies for low-cost processing, most notably, the potential to aggregate processing volume by leveraging the client’s base of retail pharmacy customers —a strategy that has been growing in popularity in the payments industry.

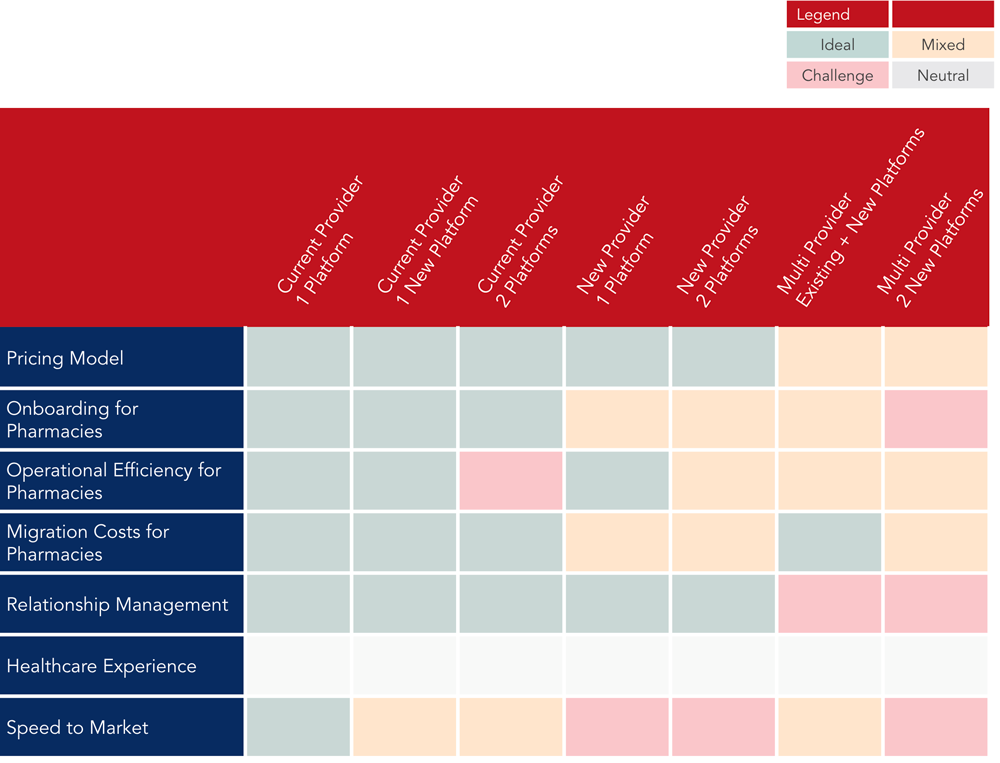

In Phase 2, Glenbrook developed an end-to-end payments strategy, then brought that strategy to life by defining requirements, creating a request for proposal (RFP), identifying, evaluating, and recommending payments processing partners, and detailing an implementation plan for the client. The visuals below illustrate how Glenbrook managed the RFP process and conducted a vendor assessment:

Impact

Upon completion of the project, the client had a payments strategy that benefited not only their independent retail pharmacy customers but also expanded the organization’s offerings and overall revenue. The client’s team gained a deeper understanding of payments within the context of their industry through Glenbrook’s Payments Boot Camp™, and key business partners were better able to support the rollout of the newfound strategy.

The post A national healthcare services company builds an omnichannel payments strategy for retail pharmacy customers appeared first on Glenbrook Partners, LLC.