Saturday, 25 February 2023

The Ethical Investor: Sustainability top of the agenda but enthusiasm not being matched by progress – here’s why

by Berkeley Lovelace

The Ethical Investor is Stockhead’s weekly look at ESG moves on the ASX.

Being a ‘sustainable’ business is now key to being a ‘successful’ business with goals such as net zero emissions, supply chain sustainability, and waste reduction playing a much bigger part in the long-term value of a company than simply representing good-to-have objectives.

Reducing one’s environmental impact can be financially lucrative and a great selling point.

Investors are increasingly paying more attention to how their investment affects society, and research suggests companies with high scores for environment, social, and governance factors (ESG) experience lower costs of capital compared to companies with poor ESG scores.

But a Fujitsu Uvance research report from a survey of 1,000 business and public sector leaders from 15 different countries has found a disappointing reality – the enthusiasm by organisations for sustainability is not being matched by real progress.

It’s called the ‘sustainability gap’ and Fujitsu finds where 61% of organisations say they are advanced on their sustainability journey, in reality, less than one in 10 have completed major sustainability imperatives such as developing sustainable supply chains (9%) or achieving net zero status (2%).

And while 77% of organisation say they think being sustainable is the right thing to, another 18% believe that it is just a fad that will pass.

Why are companies taking so long to act?

Fujitsu says in part, it is because making meaningful change is difficult, and a sustainability mindset might not be felt across the entire organisation.

In the past, Stockhead has reported on the increasingly challenging environment businesses leaders find themselves in.

CEOs are overwhelmed by the sheer number of challenges they are required to address, coupled with the uncertainty of the future.

Disruptive factors starting with COVID, to supply shortages, geopolitical issues, inflation, and the energy crisis haven’t really gone away.

Helge Muenkel, chief sustainability officer at DBS Bank, says that culture and a collective sense of purpose can remedy these issues.

“At DBS we have a wonderful vision, which is to be the best bank for a better world,” he says.

“The latter part encapsulates our approach to sustainability. And the beautiful story behind this vision is it wasn’t the brainchild of one individual, it was actually built ground up by our 350 or so senior leaders.

“Purpose is extremely important. And continuously nourishing the culture associated with that is instrumental, as it is fundamentally the most important step we need to take.”

Tracking the wrong sustainability targets

Interestingly, Fujitsu also found organisations are not yet putting the right targets and measurement strategies in place from the beginning.

Half of the organisations surveyed said they are tracking things like health and wellbeing and energy consumption, areas where data sources are readily available.

Metrics needing deeper expertise, such as carbon footprint and supply chain waste, are largely overlooked, while another 6% of companies said they are tracking nothing at all.

And that’s a big problem, according to HSBC’s Henbest.

“If you can’t measure it, you can’t manage it,” he says.

While many organisations may talk the talk about sustainability, Fujitsu’s research shows they’re not making tangible progress. They lack the culture and the hard data to make things happen.

Technology is the great Sustainability Transformation accelerator

But there is something that can help bring organisations’ sustainability goals to life – technology, and more than two-thirds of organisations surveyed (68%) state Sustainability Transformation will not be a success without it.

Anna Rahikainen, sustainability director at Finnish restaurant group Kotipizza, says to a very large extent, Sustainability Transformation is enabled by digital transformation.

“It’s a prerequisite,” she says.

“In the past, the narrative was very much about digital, but now it’s shifting toward how digital can make sustainability happen – it’s all about how we can use technology to make Sustainability Transformation happen.”

According to Fujitsu’s research, Sustainability Transformation needs sustainability and technology to be considered together.

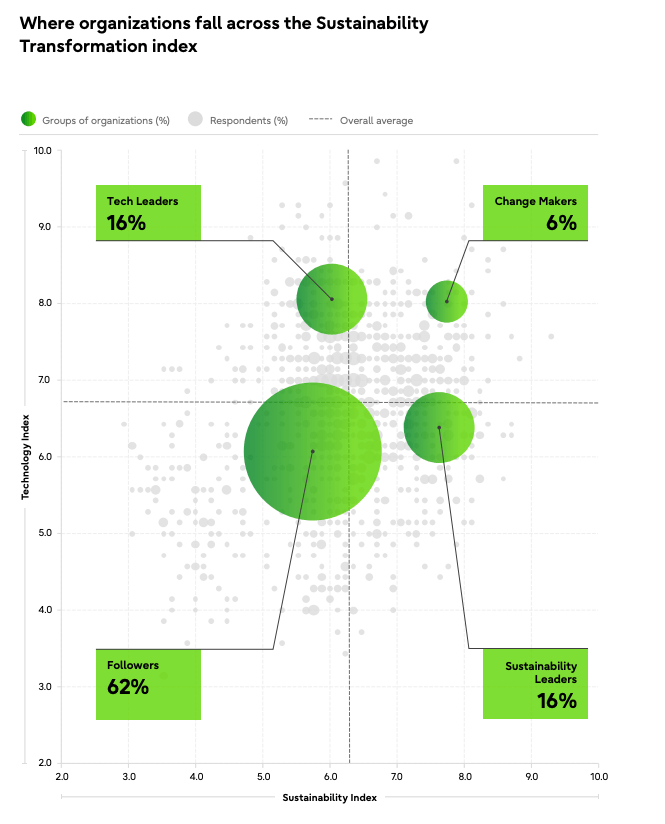

Focusing on one without the other will not work in the same way and only 6% of respondents are doing just that.

Fujitsu has called this small group of organisations the ‘change makers’, the companies looking to make an impact – the ones who share five characteristics: they are communicative, they measure success, they are innovative, they invest in technology, and they are skilled.

“Organisations that scored highest on the sustainability factors are the Sustainability Leaders, and the ones that lead on the tech scores are the Technology Leaders,” the Japanese multinational information and tech company said.

“When an organisation scores highly across both areas, it is one of our Change Makers. The rest, which lead in none of the categories, are the Followers.

“Our research shows that the way the Change Makers combine technology with sustainability leads to major competitive advantages.”

The post The Ethical Investor: Sustainability top of the agenda but enthusiasm not being matched by progress – here’s why appeared first on Stockhead.